Special depreciation - declining balance depreciation with the growth booster - opportunity for your investments

Whether Osmobil machines, robots, vacuum cleaners or complete Osmobil trailers - building cleaners who invest in modern technology can now benefit twice: through the declining balance depreciation as part of the so-called growth booster.

What is behind the growth booster?

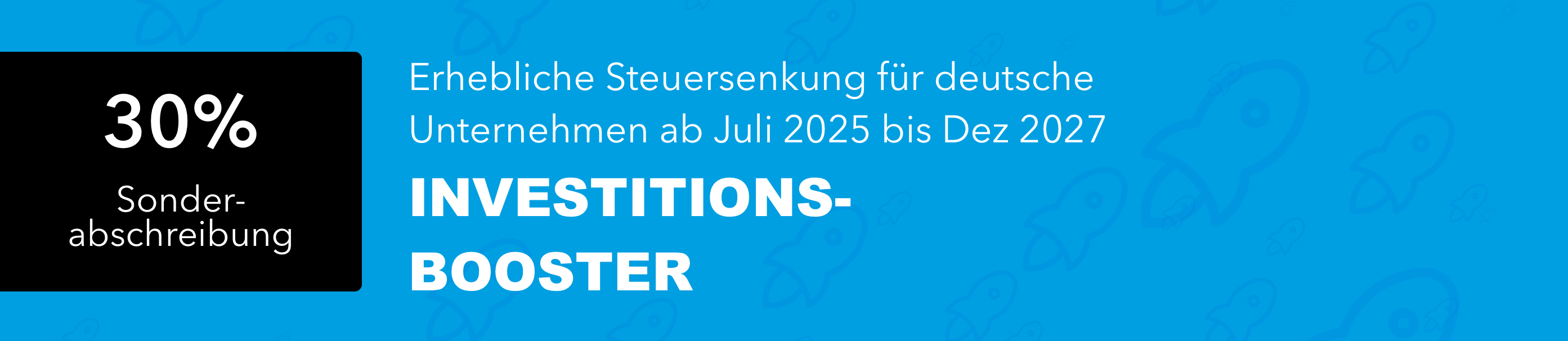

The growth booster is a legislative package from the German government designed to provide tax relief for companies and stimulate investment. One key point: certain investments in movable assets (e.g. machinery, equipment, vehicles, trailers with technology) are subject to declining balance depreciation.

Degressive depreciation explained simply

Instead of depreciating evenly over the years, the declining balance method allows companies to claim higher amounts for tax purposes in the first few years. This means: faster tax benefits immediately after purchase.

Which investments does this apply to?

- Machines (e.g. osmosis systems)

- Robots and vacuum cleaners

- Trailers / Osmobil trailers with technology

- Other movable assets that are purchased for the business

Important: The investment must be made after June 30, 2025 and before January 1, 2028.

How high is the benefit?

- Up to 30% in the year of acquisition as declining balance depreciation possible

- Thereafter, annual depreciation on the remaining residual value - this reduces the tax burden particularly significantly in the first few years.

What to look out for?

- They must be movable assets

- Acquisition in the intended period

- Concrete calculation and tax implementation best coordinated with the tax advisor

Conclusion

Regardless of whether you invest in robots, vacuum cleaners, Osmobil machines or trailers: The declining balance depreciation under the growth booster makes your investment not only technically sensible, but also attractive from a tax perspective.

Deutsch

Deutsch

French

French

Dutch

Dutch

Italian

Italian